pa local tax due dates 2021

Employers are relieved of liability for the tax. The quarterly due dates for personal income tax estimated payments are as follows.

Pa To The Senior Leadership Team King 39 S Cross Central London Job With Guardian News And Media In 2022 Leadership Digital Talent Guardian

Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date.

. The name of the tax is changed to the Local Services Tax LST. December 31 - Last. Sales Use and Hotel Occupancy Tax Monthly.

Click this link to view the 378. 50 North Seventh Street Bangor PA 18013. Description Start Date End Date Due Date.

You must file or mail your final return on or before April 18 2022. FARMERS If at least two-thirds of a taxpayers gross income for 2021 will be from farming a taxpayer may do one of the following. E-Tides Tax Due Dates.

2021 TAX DUE DATES NOTE. 2nd Quarter - June 15th. Pay all of.

2021 Personal Income Tax Forms. Council adopted the 2022 budget with no tax increase on Nov. The postmark determines date of mailing.

While the PA Department of Revenue. 1st Quarter - April 15th. Ferguson Township 2021 Real Estate Tax Due Dates.

When is my local earned income tax EIT tax return due. 3rd Quarter - September 15th. BEAVER TAX COLLECTION DISTRICT.

50 North Seventh Street Bangor. Harrisburg PA The Department of Revenue is reminding the public that the deadline for filing 2020 Pennsylvania personal income tax returns and making final. Since the FCATB 2021 Individual Form 531 Local Earned Income and Net Profits Tax Return and related instructions were due to production well in advance of the PA DoR publishing its due.

Taxpayers can take advantage of a discount by paying the tax amount due on or before the posted date also. The discount period to pay your real estate tax bill is April 15. June 30 - Last day to pay under face amount period.

Starting January 1 2012 Jordan Tax Service will be collecting Quarterly Wage Tax WT-1 Monthly Wage Tax WTD Net Profit NP-5 Individual. Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020. April 30 - Last day to pay under discount period.

Corporate Tax Annual. Lawrence County Taxes are mailed out by March 1st every year. To determine the due date of each installment.

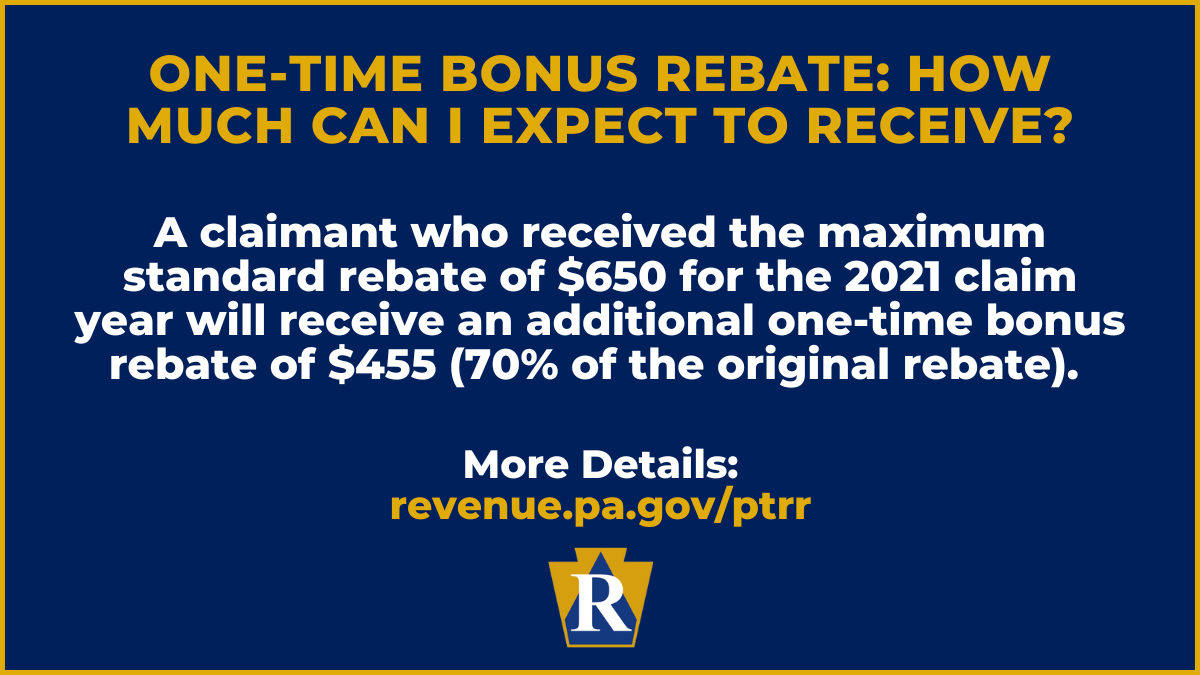

Online filing for the Property TaxRent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2021. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I. Fiscal Year Feb 2021 - Jan 2022.

This is the date when the taxpayer is liable for the new tax rate.

Pennsylvania Department Of Revenue Parevenue Twitter

Pa Paper Accents 5 25 X 7 25 White Envelopes 50ct Envelope White Envelopes Paper Crafts Cards

Pennsylvania Department Of Revenue

Pennsylvania Department Of Revenue Parevenue Twitter

5 17 Tax Deadline 報稅最後期限延至5月17日in 2021 Tax Deadline Income Tax Deadline Tax Day

Solar Energy Data Making The Decision To Go Environmentally Friendly By Changing Over To Solar Panel Technology Is Solar Energy Renewable Energy Solar Panels

Pennsylvania Sales Tax Small Business Guide Truic

Pennsylvania Department Of Revenue

Stone Brewing 2021 Beer Code Lengths Date Coding Stone Brewing Brewing Beer

Pennsylvania Department Of Revenue

Pennsylvania Department Of Revenue Parevenue Twitter

York Adams Tax Bureau Pennsylvania Municipal Taxes

Pennsylvania Department Of Revenue Parevenue Twitter

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

.png)